(Bloomberg) — Alibaba Group Holding Ltd. reported solid growth in businesses including its international and cloud divisions, helping to offset some of the drag from an anemic Chinese commerce business.

Most Read from Bloomberg

Overall sales rose about 5% after the internet pioneer’s domestic e-commerce operation eked out just 1% growth, reflecting the poor consumer sentiment plaguing its core business. But the international division, which encompasses Lazada and the Temu-like AliExpress, expanded revenue 35% — again outshining all other segments. The cloud unit accelerated revenue growth to more than 7%, suggesting it’s beginning to claw back market share lost to state rivals.

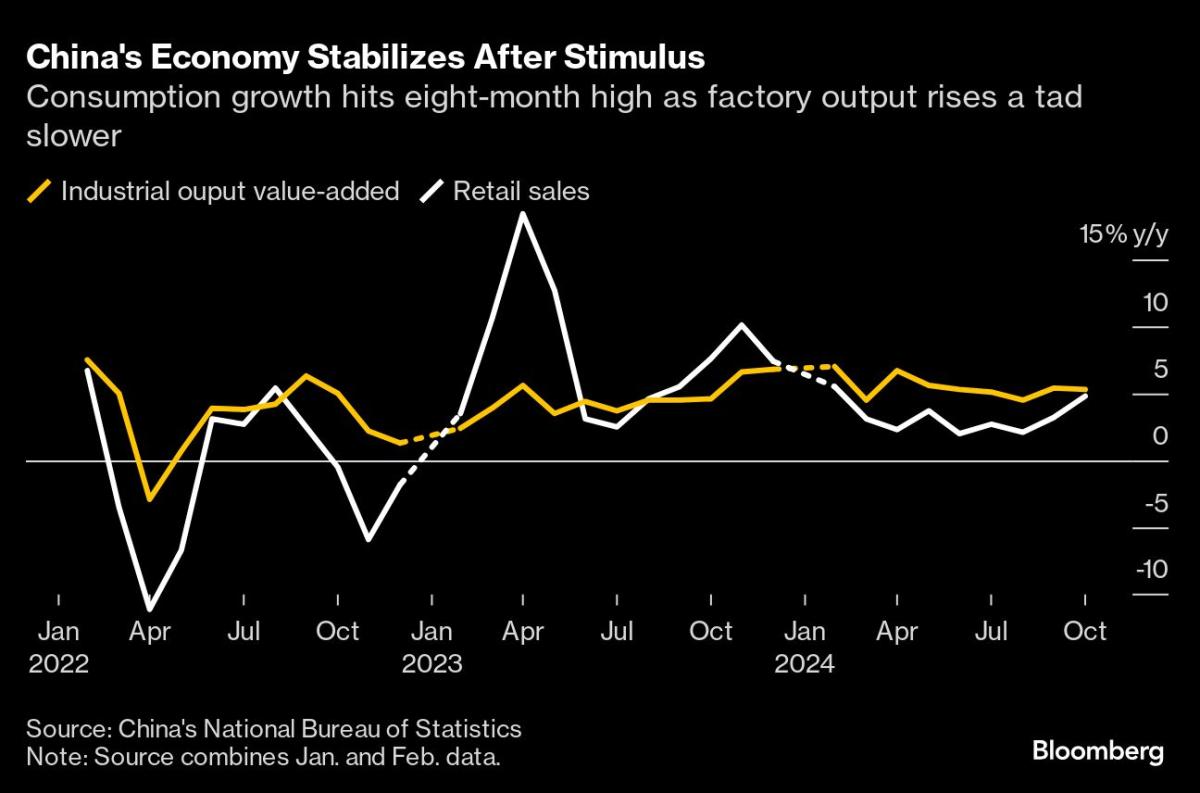

Alibaba’s shares rose about 3% in pre-market trading in New York. The company is reporting hours after the latest economic data showed encouraging signs for the world’s second largest economy. Retail sales grew at their strongest pace in eight months.

That’s a positive for Alibaba, which is more than a year into a turnaround effort spearheaded by Chief Executive Officer Eddie Wu. The company that once dominated online commerce across China is struggling to regain the growth it once enjoyed, before a bruising government-led antitrust investigation bolstered rivals like PDD Holdings Inc.

Follow Alibaba Second-Quarter Earnings in Real Time: TOPLive

In August, regulators said Alibaba has ceased all monopolistic acts as they wrapped up a three-year rectification period for the company.

Its revenue climbed to 236.5 billion yuan ($32.7 billion) in the September quarter, versus an average estimate for 239.4 billion yuan. Net income rose 58% to 43.9 billion yuan, though a big part of that came from gains in its investments.

“We are more confident in our core businesses than ever and will continue to invest in supporting long-term growth,” Wu said in a statement.

Alibaba’s domestic commerce business shrank for the first time in at least a year during the June quarter, driving home the malaise plaguing the country and its leading online retailer. Taobao-Tmall has since September begun to charge merchants a software service fee that’s common on rival platforms like PDD and JD.com Inc.

The policy change, coupled with new marketing tools on Alibaba’s flagship sites, could boost revenue at its core division over the long run.

There’re other promising signs. Alibaba reported robust sales growth for the month-long Singles’ Day shopping season — the marquee event it invented more than a decade ago that now serves as a barometer for Chinese consumer spending.

JD.com and Tencent Holdings Ltd. have also outlined signs of recovery in the broader economy, though both warn that a fuller rebound will take time. And some analysts warn that the lack of comprehensive data is hampering efforts to gauge the economy’s trajectory. Alibaba, for instance, didn’t disclose overall sales for Singles’ Day.

Despite their rivalry, Alibaba and JD.com formed an unlikely alliance during the downturn. Starting with Singles’ Day, the pair opened up their in-house logistic services to each other’s shopping platforms. JD.com also welcomed Alipay as a payment option, while Alibaba deepened collaboration with Tencent’s WeChat Pay, which has been essential to JD’s growth.

What Bloomberg Intelligence Says

Alibaba’s Taobao-Tmall customer management revenue (CMR) gain in fiscal 2Q ended September could have trailed consensus estimates of a 3.2% year-over-year uptick amid weak business and consumer sentiment in China during the period. The year-over-year rise in 2Q gross merchandise volume (GMV) on Taobao-Tmall platforms probably also trailed the high-single-digit gain recorded in the preceding quarter as a result. Efforts by the firm to narrow the trailing growth in CMR to GMV gains may only become more evident in the quarter ending December following new measures to boost merchants’ conversion rates and reduce their operating costs on TTG platforms.

The lift to Alibaba’s e-commerce revenue growth from its enlarged overseas operations via the international digital commerce unit (AIDC) and Cainiao likely persisted in 2Q.

– Catherine Lim and Trini Tan, analysts

Click here for the research.

The economic downturn had also weighed on the once fast-growing cloud business, which hosts computing for corporate clients. After years of driving growth across its businesses, the division has managed marginal growth in recent quarters.

For now, two key divisions have helped offset the drag from online commerce.

Alibaba’s Cainiao logistics arm and its international division have ranked among its best-performing businesses, helping prop up growth. Alibaba’s Singapore-based Lazada arm is fighting a resurgent Sea Ltd. and even ByteDance Ltd., which recently expanded its footprint in Asia by swallowing Indonesia’s Tokopedia.

Wu, who replaced Daniel Zhang at the helm more than a year ago, is focused on enhancing its twin businesses of commerce and cloud computing, while making bets on AI technology for the longer term. He and Chairman Joseph Tsai — two of the company’s earliest employees — are longtime close confidants of co-founder Jack Ma.

–With assistance from Zheping Huang, Vlad Savov and Debby Wu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link