(Bloomberg) — Google parent Alphabet Inc. posted fourth-quarter revenue that missed analysts’ expectations as growth in its cloud business slowed. The shares fell more than 8%.

Most Read from Bloomberg

Sales, excluding partner payouts, were $81.6 billion, Alphabet said Tuesday in a statement. Analysts had projected $82.8 billion, according to data compiled by Bloomberg.

The company also projected $75 billion in 2025 capital expenditures, far exceeding the $57.9 billion that analysts expected, related to a buildout of data centers and infrastructure for artificial intelligence. That led to a more than 6% boost in Broadcom Inc. shares.

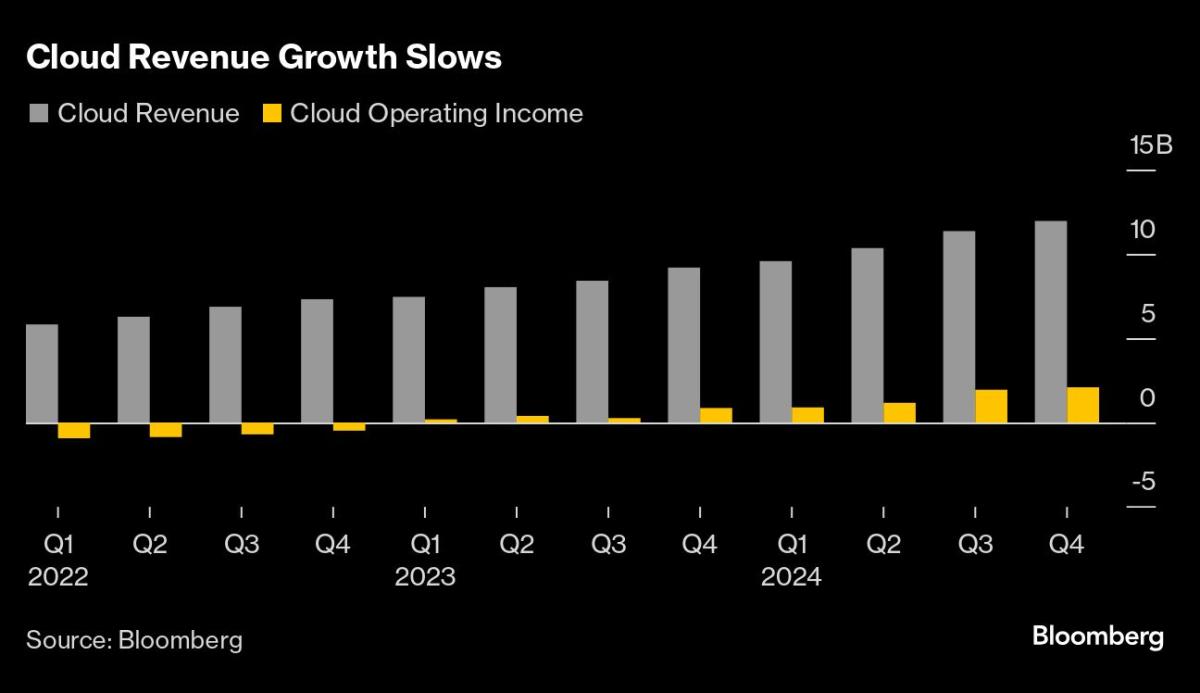

Investors have urged Alphabet to demonstrate that it is maintaining momentum across its businesses as it spends more heavily on AI, and as competition in that market intensifies. Google’s cloud unit had benefited from the AI boom as startups required more computing power for their work, but sales of about $12 billion in the period ended Dec. 31 missed estimates. Google Cloud still trails behind Amazon.com Inc. and Microsoft Corp. in size.

Alphabet fell as low as $189.40 in extended trading, after closing at $206.38. The shares have gained 9% so far this year.

Investors will be looking for reassurance that AI spending isn’t excessive after Chinese AI startup DeepSeek took Silicon Valley by surprise when it said it had created a powerful AI model at a fraction of the cost of US rivals.

In the quarter, net income was $2.15 per share, compared with Wall Street’s $2.13 per-share estimate.

Search advertising brought in $54 billion in sales, slightly beating analysts’ estimates. Google has long dominated the market, which is newly under threat by both AI competitors and antitrust challenges.

In August, a US judge ruled that Google monopolized the search market through illegal deals. The Justice Department and a group of states also allege that Google has violated antitrust law for the technology used to buy and sell website ads, harming publishers and advertisers in the process. Key proceedings in both cases are expected in 2025.

YouTube reported $10.5 billion in revenue, exceeding analysts’ estimates of $10.2 billion. On the earnings call with investors, Chief Business Officer Philipp Schindler said an early investment by YouTube in podcasts, which were popular during the US election, and which drove an increase in ad spending by both parties, is paying off.

Alphabet’s Other Bets, a collection of futuristic businesses that includes the life sciences unit Verily and the self-driving car effort Waymo, generated $400 million in revenue, missing estimates for $592 million. Alphabet has been aggressively expanding Waymo, which recently announced plans to test in 10 new cities in 2025. But the other units have been pressured to spin off as independent startups.

(Updates with business units starting in seventh paragraph)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Source link