(Bloomberg) — ASML Holding NV (ASML) surged the most since 2020 after booking orders worth twice as much as analysts expected, as the artificial intelligence boom fuels demand for its chipmaking machines.

Most Read from Bloomberg

The Dutch company reported bookings of €7.09 billion ($7.4 billion) in the fourth quarter, it said in a statement on Wednesday. That compares with an average estimate of €3.53 billion by analysts surveyed by Bloomberg.

ASML stands to benefit from the billions of dollars companies have pledged to build up AI capacities. Meta Platforms Inc. (META) announced plans on Friday to boost capital expenditures on AI projects this year by about half to as much as $65 billion. That came on the heels of OpenAI, SoftBank Group Corp. and Oracle Corp. (ORCL) announcing a $100 billion joint venture called Stargate to build out data centers and AI infrastructure projects around the US.

“AI is the clear driver,” Chief Executive Officer Christophe Fouquet said in a video accompanying the results. “We truly believe that AI is going to bring even more opportunity to this semiconductor industry.”

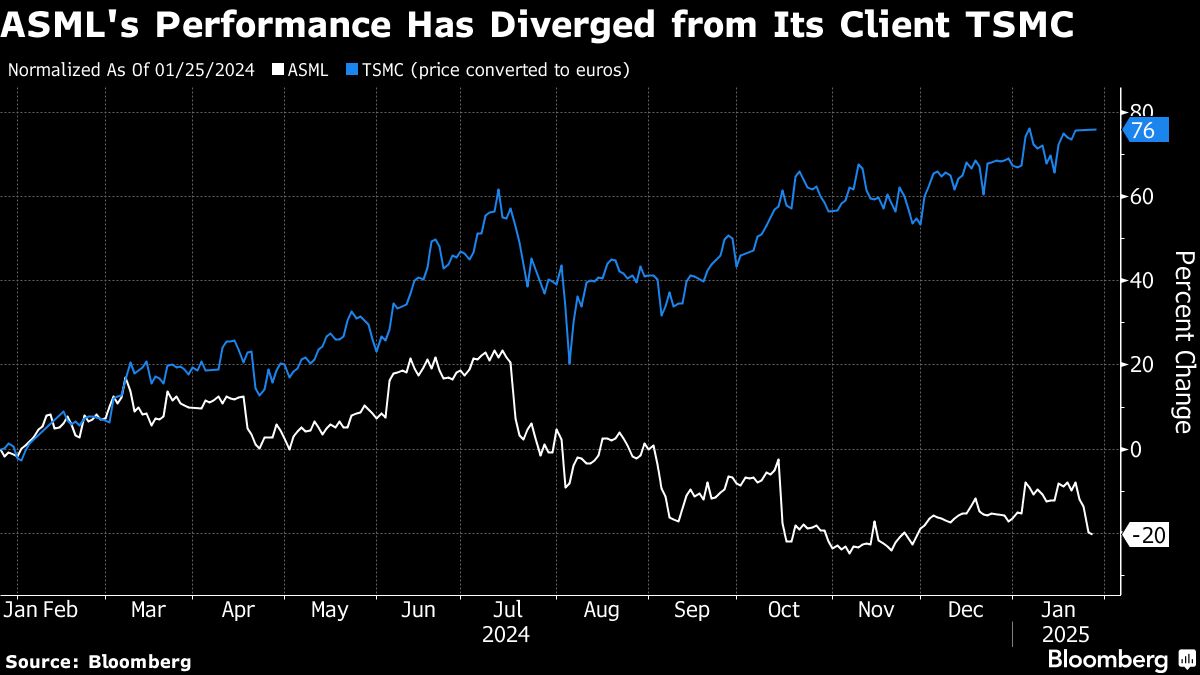

ASML shares rose as much as 12% to €722.10 in Amsterdam, the biggest intraday gain since March 2020. They more than fully recovered from a drop earlier in the week on concern that a new AI model by Chinese startup DeepSeek can provide comparable performance to Western chatbots at a fraction of the price. ASML makes machines needed to produce some high-end chips that the Chinese company is barred from purchasing.

Net bookings were driven by demand for ASML’s most-advanced extreme ultraviolet lithography, or EUV, machines, for which €3 billion of orders were placed in the period. China, which had been the company’s biggest market for five quarters, slipped to second place behind the US.

In a bid to stall China’s progress in AI, the US has banned the export of advanced semiconductor technologies to its geopolitical rival. ASML has never been able to sell its EUV machines to China because of US-led restrictions. Last year, the Dutch government also blocked immersion deep ultraviolet lithography systems to the country after pressure from the Biden administration.

DeepSeek’s progress suggests Chinese AI engineers have found a way to work around the bans, focusing on greater efficiency with limited resources. Its latest model raised questions about the effectiveness of the trade curbs.

“Anyone that lowers cost is good news for ASML,” Fouquet said at a press conference on Wednesday. “Lower cost means AI can be used in more applications, more applications mean more chips.”

Despite the growing number of restrictions, ASML benefited from strong demand from China last year as chipmakers there bought up older kit used to make more mature types of semiconductors.

China accounted for €1.92 billion of sales in the fourth quarter, 27% of ASML’s total. The company expects China sales to fall to about 20% of total revenue this year.

“2025 will be a year where we see China going back to a more normal ratio in our business,” Fouquet said in the video.

US pressure on ASML to further restrict sales of semiconductor technology to Beijing will likely grow under President Donald Trump, Dutch Prime Minister Dick Schoof said in an interview with Bloomberg at the World Economic Forum last week in Davos.

ASML’s shares are down more than 25% from a July peak and it has ceded the title of Europe’s most valuable technology company to Germany’s SAP SE.

One of ASML’s top customers, Taiwan Semiconductor Manufacturing Co., this month said it foresees spending $38 billion to $42 billion on technology and capacity in 2025, as much as 19% more than analysts expected.

ASML said it recognized revenue in the quarter on two high-NA EUV systems, which are its new state-of-the-art lithography machines that cost more than €350 million apiece. TSMC and Intel Corp. were expected to receive such machines by the end of last year.

ASML will stop reporting order bookings after 2025, as “bookings can be lumpy and are not necessarily a good reflection or an accurate reflection of the business momentum,” it said. It will instead provide its total backlog on an annual basis.

The company unveiled a total dividend for 2024 of €6.40 per ordinary share, which is about a 5% increase from the year before. ASML kept its net sales outlook for 2025 unchanged at €30 billion to €35 billion.

(Updates with CEO comments in the ninth paragraph.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Source link