Crypto’s ‘Middle Child’ Ethereum Flounders as Rivals Gain Ground

(Bloomberg) — Ethereum faces pressing questions over its direction as a rejigged user experience saps activity and fees, stoking uncertainty about whether the blockchain will continue to underpin commerce in crypto.

Most Read from Bloomberg

Critics point to a growing reliance on so-called Layer-2 blockchains, built on top of Ethereum to improve otherwise clunky and costly transactions. Layer-2 operators like Arbitrum and Optimism have reaped the rewards. Since March, Layer-2 transactions are up 430%, while fees collected by Ethereum have fallen 87% in the same period, data compiled by Bloomberg show.

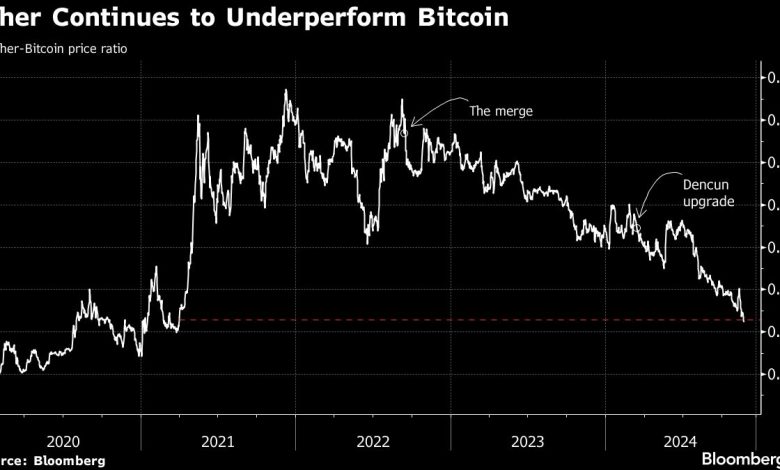

The performance of Ethereum’s token, Ether, underscores the muddy outlook. It’s up about 75% in the past year, a period when Bitcoin more than doubled. Bitcoin lately also scaled record highs atop president-elect Donald Trump’s embrace of digital assets, whereas Ether remains far from all-time peaks.

“The layer-2 road map shipped without careful examination of the economics,” said Max Resnick, head of research at Special Mechanisms Group, which is owned by Ethereum developer Consensys Systems. “It’s clearly a concern.”

‘World Computer’

Founded over a decade ago with the aim of creating a “world computer,” Ethereum made it easier to build blockchain-based applications, turbo-charging the decentralized finance — or DeFi — ecosystem where people trade, lend and borrow digital assets peer-to-peer using automated software.

The network supports over $72 billion in tokens locked in DeFi apps, as well as over $100 billion of the nearly $190 billion stablecoin market, according to data from DefiLlama. But what has long been considered a dominant position is perhaps for the first time under threat.

While the blockchain has “ceded some pricing power” in the short term, it has done so to allow “all the Layer-2s to establish themselves and grow and flourish,” said Consensys Chief Executive Officer Joseph Lubin.

In the US exchange-traded fund sector, Ether products have received a tepid reception, recording a net inflow of $242 million compared with a $31 billion flood into Bitcoin ETFs in 2024, according to data compiled by Bloomberg.

Growing Supply

Since the blockchain’s “Dencun” upgrade in March, Ether supply has turned inflationary: the number of tokens in circulation is rising. An earlier upgrade, “The Merge” in 2022, was supposed to prevent that and lure investors.

Source link