(Bloomberg) — The Biden administration has finalized a deal to give Intel Corp. nearly $7.9 billion in federal grants, the largest direct subsidy from a program to boost domestic semiconductor manufacturing.

Most Read from Bloomberg

The agreement for the struggling chipmaker, smaller than an earlier proposed award, means that Intel can begin receiving funds as it hits negotiated benchmarks on projects in four US states. The company will qualify for at least $1 billion this year, a senior administration official said, based on milestones it has already reached.

Specifically, Intel will get money for projects in Arizona, Oregon and New Mexico, according to a person familiar with the matter, who asked not to be named as the details are not public. The company’s greenfield site in Ohio, which has been delayed by several years, is not yet eligible for any federal support, the person said, though it has already received $2 billion from the state.

Wrapping up talks has been a top priority for Intel, which has spent months trying to convince Wall Street and Washington that it can execute on a massive manufacturing expansion despite deep financial struggles and years of technological blunders. It’s also an important step for President Joe Biden’s administration, which is trying to insulate its industrial policy initiatives from potential changes under President-elect Donald Trump.

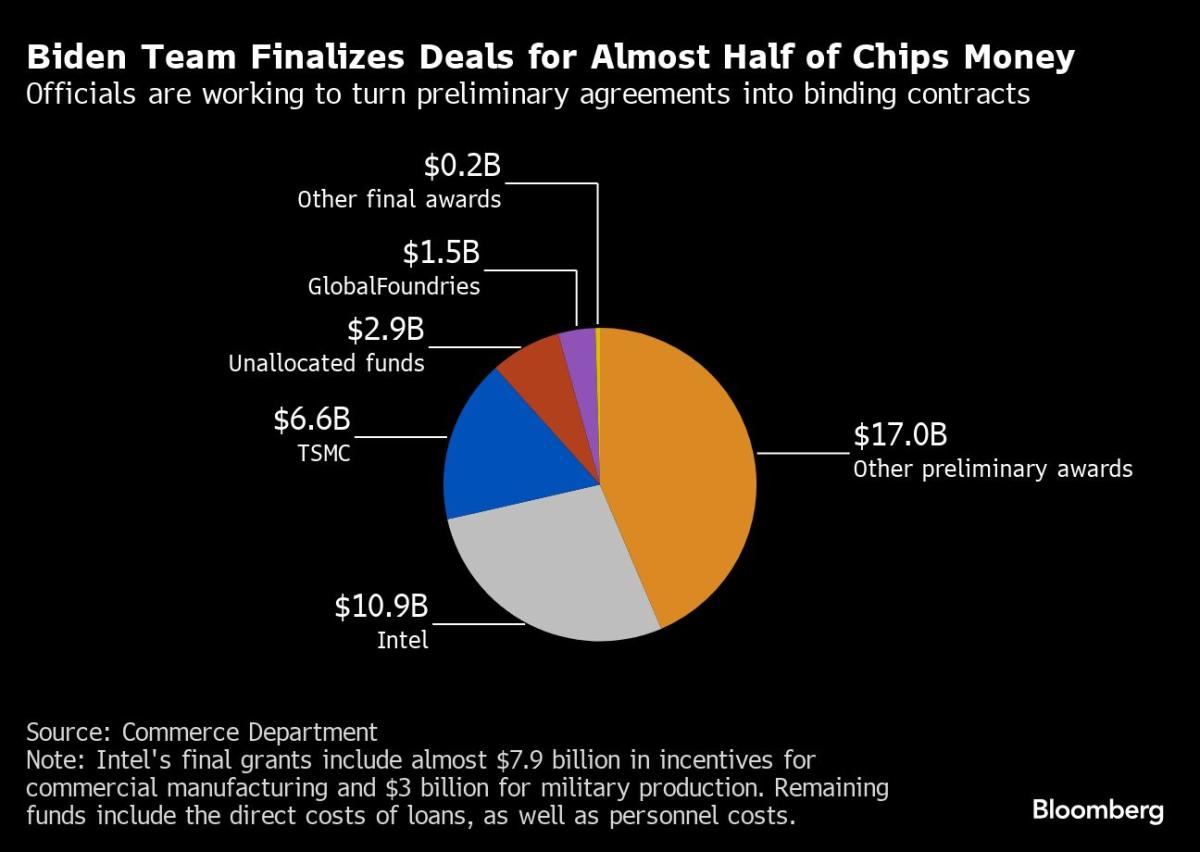

Intel’s award will result in “American-designed chips being manufactured and packaged by American workers, in the United States, by an American company, for the first time in a very long time,” said Commerce Secretary Gina Raimondo, whose agency is in charge of implementing the 2022 Chips and Science Act. The landmark bipartisan law set aside $39 billion in grants, $75 billion in loans and loan guarantees, and 25% tax credits to revitalize American chipmaking.

Biden officials have staked a significant portion of their semiconductor ambitions on Intel, the lone American maker of advanced processors. The company has promised to spend $100 billion on US factories — amounting to nearly a quarter of the total private investment spurred by the Chips Act — and is supposed to make semiconductors for the military. That makes Intel’s projects crucial for national security and the country’s broader goal of reaching 20% global market share for leading-edge logic chips.

But US officials have also had to contend with Intel’s significant business challenges, which have only grown more apparent since it announced a preliminary award in March. Intel’s disastrous August financial report stoked concern among investors about the viability of Chief Executive Officer Pat Gelsinger’s turnaround plans. Government negotiations stalled over disagreements about how much information Intel would have to share with federal officials seeking to vet its technology road map, Bloomberg has reported, as well as terms spelling out what happens if the company spins off its manufacturing business or is purchased in part or in whole.

Reduced grant, no loans

Intel was originally in line to win $8.5 billion in Chips Act grants and $11 billion in loans. The final deal has a reduced grant and Intel chose not to take any loans, the senior official said, without elaborating on the reasons why.

The funding cut is not because of Intel’s broader business challenges, they said. Rather, it reflects a separate $3 billion grant for Intel to make advanced chips for the military, according to the administration official and several other people familiar with the talks.

That program, called Secure Enclave, was originally supposed to get the majority of its funding from the Pentagon. But in February, Defense officials pulled out of their share of the deal, and lawmakers then saddled the Commerce Department with the responsibility. Commerce officials folded some of their new obligations into Chips Act money already set aside for Intel, Bloomberg has reported, reducing the total amount of funding the chipmaker ultimately received.

Project delays

Intel’s initial proposed award was slated to support all of its US projects. But the company has since delayed construction at key sites, meaning that around 10% of Intel’s total planned capital expenditure falls after 2030 — which is the deadline to receive government support.

In Ohio, where construction was originally supposed to finish in late 2026, Intel now plans to complete its first factory by the end of the decade, and the second not until after 2030. That means that the chipmaker’s final award will only support the first Ohio plant, according to the administration official and another person familiar with the matter.

Intel’s Arizona site is also slightly delayed. Production there, originally expected to begin by the end of this year, will now start in 2025, the senior official said. The company has already completed construction at an advanced packaging plant in New Mexico, and made investments in a research and development facility in Oregon.

All told, Intel has spent $30 billion on its US buildout, on which Gelsinger has hinged an ambitious corporate comeback.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link