(Bloomberg) — Intel Corp. reported better-than-projected fourth-quarter revenue, while the semiconductor maker cautioned that its push to become more competitive is still a work in progress.

Most Read from Bloomberg

Intel gained as much as 2.9% in premarket trading on Friday, after closing at $20.01 in New York.

While the $14.3 billion in fourth-quarter sales beat estimates, part of that was from customers in Asia ordering ahead of possible US tariffs, executives said. First-quarter sales will fall short of analysts’ projections because of weaker demand and market share loss to rivals.

Investors responded positively to the realistic tone set by the chipmaker’s interim CEOs. “There are no quick fixes,” Chief Product Officer and interim co-CEO Michelle Johnston Holthaus said on a call with analysts.“As co-CEOs, you can expect us to be very straightforward and direct. We only make commitments we are confident we can deliver.”

She and Chief Financial Officer Dave Zinsner, the other co-CEO, said they’re focusing on improving Intel’s products and manufacturing to win back customers from the likes of Advanced Micro Devices Inc. and Taiwan Semiconductor Manufacturing Co., while improving finances and avoiding speculative bets.

The chipmaker didn’t give a status update on its search for a new CEO. The eventual new leader is expected to address options that include a breakup. Competitors are considering bids for all or parts of the company.

First-quarter revenue will be $11.7 billion to $12.7 billion, the Santa Clara, California-based semiconductor company said Thursday in a statement, missing the $12.85 billion average analyst estimate. Profit excluding some items will be break-even, compared with the 8 cents a share analysts were projecting. The estimates reflect a tough competitive environment and weaker demand, Zinsner said.

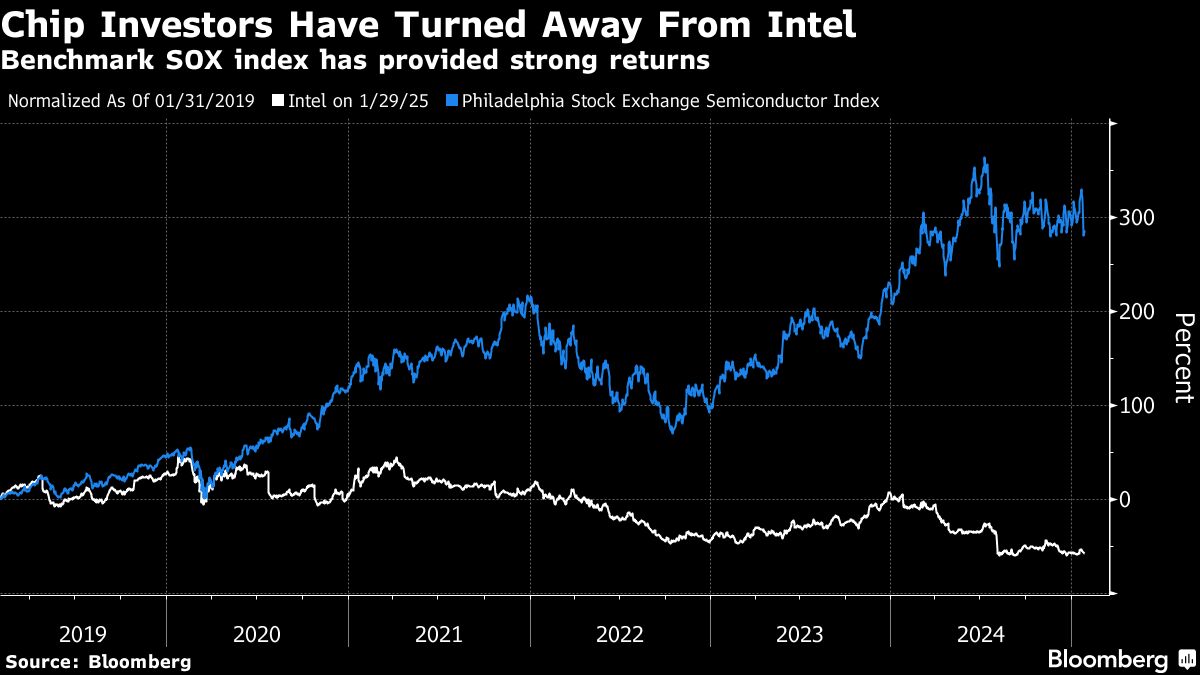

In the fourth quarter, the company had a loss of 3 cents a share, excluding certain items. The shares have lost more than 50% of their value in the last 12 months.

Intel, until recently the world’s largest chipmaker, ended 2024 with its lowest revenue in more than a decade after posting a third straight annual decline. CEO Pat Gelsinger was pushed out in December by the board.

Gelsinger, who rejoined Intel as CEO in 2021 to turn it around, had insisted Intel was better kept whole and that his expensive spending plan would return its manufacturing and products to industry prominence. He didn’t last the five years he said it would take for his plan to bear fruit.

Investors, who initially supported his initiatives, deserted the company’s stock when the spending on new plants, equipment and research took a massive toll on finances. Meanwhile, rivals better exploited an industry shift to artificial intelligence technology, eroding Intel’s market share. Gelsinger partially addressed the issue by reducing spending and cutting 16,000 jobs, but Intel still needs to improve its chips, particularly artificial intelligence accelerators, in order to restore top-line growth.

Intel has been unable to produce a viable alternative to Nvidia Corp.’s accelerator chips, products that are delivering more than $100 billion in annual revenue for that company. Meanwhile, longtime rival AMD is eating away at Intel’s market share in personal computer and server processors, and other companies using mobile-phone derived processors are trying to break in to Intel’s biggest market. TSMC now has the best technology in the industry and is providing outsourced manufacturing to Intel’s rivals, taking away what used to be its main advantage.

Holthaus said that while Intel’s new PC chips are comparable with rivals, it still has work to do to offer better server chips for data centers.

“We’re fighting really hard to close the gap,” she said. “We certainly have more work to do.”

Gross margin, or the percentage of sales remaining after excluding the cost of production, was 39.2% in the fourth quarter and will be 33.8% in the current period. At its peak, Intel regularly reported gross margin of well above 60%. Nvidia’s is above 70%.

Intel now reports its earnings by divisions — an arrangement that exposes its manufacturing operations to greater scrutiny. The so-called foundry unit is seeking outside customers to help provide enough work for its growing footprint. For now, Intel’s designers are its only sizable customers.

Intel Foundry Services sales fell 13% from the prior-year quarter to $4.5 billion, in line with estimates. PC chip sales were $8 billion, versus an estimate of $7.9 billion. Intel’s data center and AI chip unit had sales of $3.4 billion, down 3% from a year earlier.

IFS will get revenue from external customers by packaging chips made elsewhere this year. Sales from manufacturing chips for others will start helping improve Intel’s finances by 2027, when the company aims to have the unit break even, according to Zinsner. Overall spending on new plants and equipment will be about $20 billion this year, he said. That’s down from an earlier budget for as much as $23 billion.

(Updates with premarket shares)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Source link