(Bloomberg) — Meituan’s quarterly revenue climbed a better-than-expected 22%, signaling a gradual recovery in online commerce and travel as Beijing tries to jumpstart the economy.

Most Read from Bloomberg

China’s meal delivery leader posted sales of 93.6 billion yuan ($12.9 billion) in the September quarter, versus the 92 billion yuan average projection. Net income tripled to 12.9 billion yuan.

Meituan’s outperformance suggests online commerce and travel remained resilient in the months leading up to stimulus measures that Beijing hopes will boost consumer confidence and revive the world’s second largest economy.

From Tencent Holdings Ltd. to Alibaba Group Holding Ltd., China’s tech leaders delivered underwhelming numbers for a quarter beset by economic and geopolitical uncertainty. Whether or not they can win back investors may increasingly hinge on Beijing’s actions.

Alibaba reported sluggish growth in its Chinese e-commerce business, while PDD Holdings Inc. warned profits will trend downward over time. Still, JD.com Inc.’s quarterly revenue rose moderately, suggesting that Chinese consumers are cautiously spending again at least in certain segments.

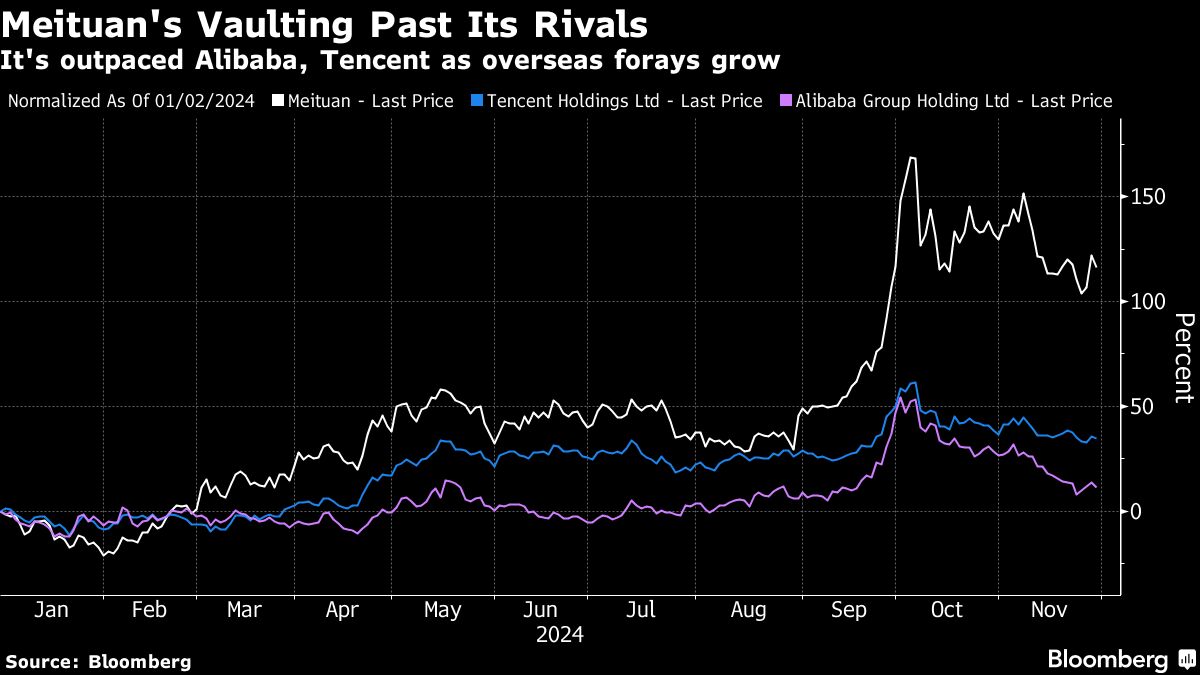

Investors have remained sanguine on Meituan, in part because of successful forays abroad. Its shares have more than doubled since the start of the year.

Beijing-based Meituan is exploring overseas markets because of a domestic slowdown. This year, billionaire founder Wang Xing took over the company’s international businesses, which for now are centered on the fledgling KeeTa app — already No. 2 in Hong Kong by some measures.

Keeta started a trial operation in Saudi Arabia in September, the first expansion beyond the Greater China region. Executives said earlier this year that Meituan has started to consider the feasibility of other markets from Europe to Southeast Asia.

What Bloomberg Intelligence Says

A wider range of low-priced meals from July-September may have boosted order frequency from existing users while wooing new ones, delivering improved scale economies at its food delivery unit. Meituan’s growing Instashopping unit, supported by 30,000 warehouses in October vs. about 8,000 in May, likely delivered lower unit costs of sales and delivery, with expanded merchandise offerings and deeper customer reach in mainland China. Meituan’s profits from in-store, hotel and travel businesses probably also rose year-over-year as demand for group purchases and travel deals stayed strong this summer.

– Catherine Lim and Trini Tan, analysts

Click here for the research.

But that adds to already ballooning costs. Meituan is spending heavily to protect its user base from new entrants, sapping margins. It’s been relying on its familiar subsidy-heavy strategy to draw in merchants and users despite the economic malaise.

The company has also ramped up investments in past years in newer initiatives such as grocery retailing, group-buying and live-streaming. It held talks with Delivery Hero about potentially acquiring the Foodpanda business in Southeast Asia, though those discussions ultimately went nowhere.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link