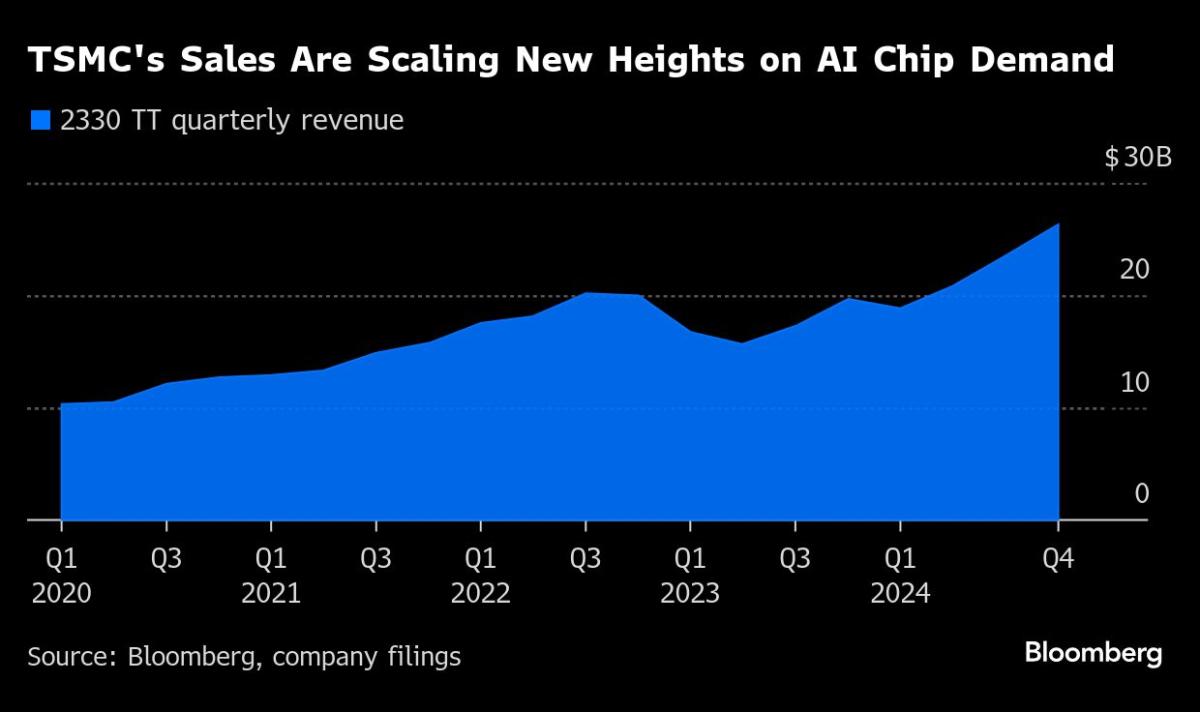

(Bloomberg) — Taiwan Semiconductor Manufacturing Co.’s profit in the December quarter topped estimates with a 57% rise, giving a boost to investors hoping to see the AI hardware spending spree extend into 2025.

Most Read from Bloomberg

The world’s biggest chipmaker reported net income of NT$374.7 billion ($11.4 billion) on Thursday. That compares with an average profit estimate of NT$369.8 billion, after the company disclosed better-than-projected sales last week.

The strong performance extends a winning streak dating back years, as TSMC has outperformed profit estimates in all quarters but one since summer 2019. That run, initially driven by Apple Inc.’s iPhone and iPad, has been turbocharged by an artificial intelligence spending cycle that lifted Nvidia Corp. to a valuation beyond $3 trillion. As the main chipmaker to Apple and Nvidia, TSMC is closely watched for its outlook on the broader electronics industry.

Follow Chip Giant TSMC’s Quarterly Results in Real Time: TOPLive

The world’s largest maker of advanced chips has been one of the biggest beneficiaries of a global race to develop artificial intelligence. TSMC’s shares jumped over 80% in 2024, marking the biggest percentage gain since 1999.

ChatGPT spurred a frenzied AI infrastructure build-out over the past two years, though the lack of a big profit-generating AI application so far has stoked concerns about a potential bubble.

The Taiwanese company is also grappling with uncertainties stemming from the US-China tech conflict. The US this month announced new export control rules on AI chips to curtail their flow to China. Apple remains TSMC’s largest customer and iPhones sales are expected to be muted.

TSMC executives will be sharing their outlook on revenue and capital expenditure during an earnings conference call starting at 2 p.m. (0600 GMT) in Taiwan. Morgan Stanley said last week it expects the company to guide toward 2025 sales growth in the low-20% range in dollar terms.

“For the driver, besides the ongoing robust AI chip demand, there will be support from new smartphone chips and AI PCs, possibly more outsourcing orders from Intel, and WiFi 7 chips,” Bloomberg Intelligence analyst Charles Shum said about the 2025 revenue outlook.

What Bloomberg Intelligence Says

TSMC may be able to retain over half of its existing orders from China, following the Biden administration’s restrictions on advanced-chip production for country-exempt chips with fewer than 30 billion transistors, as reported by Bloomberg News. This would allow TSMC to maintain sales of smartphone SoCs and mid-range computing chips for China. Chinese chip orders accounted for 12.6% of TSMC’s revenue in January-September.

-Steven Tseng, BI analyst

Geopolitical tensions have pushed TSMC to expand globally. Investors will be focused on how factories in Arizona and Japan ramp up and whether additional expansion plans stay on track or get delayed.

TSMC is planning more plants in Europe with a focus on the market for artificial intelligence chips, according to a senior Taiwanese official. That’s on top of the German plant under construction in Dresden.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Source link